This will be your actual balance, which is a better picture of how much you have to spend because it includes payments that might not have hit your bank account yet. So what do you do if your numbers and the bank’s numbers checkbook accounting don’t align? That’s when it’s time to backtrack through your records and the bank’s transaction history to see where the discrepancy is. Perhaps you forgot to record a transaction or you transposed a couple of numbers.

Step 1. Check the balance on your bank statement

If you forget or miscalculate an entry in your checkbook register, you may think you have more money than you actually do. This could result in returned check fees, overdraft fees, or a bounced check. Assuming all the transactions from your statement and your register match, the end balance showing for each one should also be the same.

- Now that you’ve reviewed every transaction, your account should be free of any surprises.

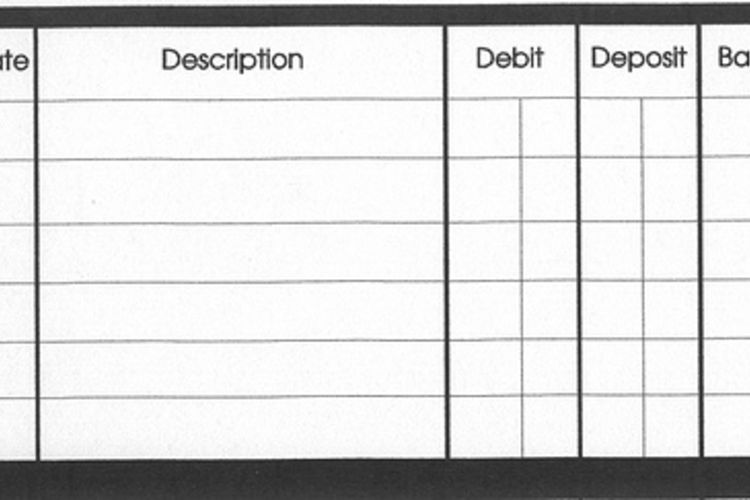

- By making a check register, you see how much money is available to spend in your business checking account.

- Or you can keep receipts and then enter them all in when you get home, or at the end of the day.

- Making a practice of doing this consistently will help you avoid small discrepancies when reconciling your bank statements.

Financial institution reviews

You can use the password manager built into your browser or operating system or download one from a third-party provider, such as 1Password, Dashlane, or NordPass. Look for an entry in your account called “ending balance,” “previous ending balance,” or “beginning balance.” Enter this figure on your form or spreadsheet. The line lets you know where you finished balancing, so you can pick up where you left off next month. Either way, do the math to make sure the bank’s total is the same as yours.

What does it mean to balance your checkbook?

You can also review your register for mathematical errors that would result in an incorrect balance. You may prefer using a budgeting app if you have multiple bank accounts or credit cards, as it’s easier to see them all in one place. Relying on these apps alone to balance your checkbook can be problematic, however, if you’re not keeping a close eye on each account individually.

If you’re using the checkbook register method and comparing transactions with your account statement, you should balance your checkbook every month. If you’re using online banking or mobile banking to track your accounts, you can log in daily to view new credit and debit transactions as well as balance information. With online and mobile banking apps, you may be able to get real-time access to your accounts and get notifications when your bank account is at risk. But even with access to digital tools, balancing your checkbook monthly will help you ensure that your spending records align with your bank’s. ClearCheckbook.com is an extremely easy way to balance your checkbook online, track your spending, set a budget, manage your money and more. As an online checkbook, you enter your receipts into the site and assign each transaction to an account and category.

Or you may have written down an incorrect amount in your register. It’s rare, but it does happen — you might lose Internet access when you need to transfer some funds. Checks are a pretty failsafe method if you can’t cover the amount in cash.

Depending on the software, you may even be able to do things like sort the register by a certain date or attach a file to a transaction (e.g., copy of receipt). Although it’s more costly than other options, accounting software can help you steer clear of check register mistakes and save time. Then, subtract outstanding items such as withdrawals and payments that haven’t yet shown up as transactions but which you know will hit your account soon. For example, you might have written a check to somebody who has not yet cashed it. Or, you might know that your mortgage payment will be deducted automatically soon.

You’ll need to be pretty good at math on the fly or use a calculator if you prefer the checkbook register method. Never write a check if your account does not have adequate funds to cover it. The time it takes a check to clear varies by bank and transaction, so it is in your best interest to always know your actual account balance. This is one of the reasons it’s a good idea to balance your checkbook more often than once a month, especially if you are newly adopting this financial task.

Once you add back withdrawals or subtract deposits, your current balance and statement balance should be the same. When you’re done reconciling your transactions, add up the cleared charges on your checkbook register or spending tracker. Any time you write a check, make a payment using your debit card, or initiate any other kind of debit or withdrawal, always record the transactions in your spending tracker or checkbook ledger. To “balance a checkbook” — in its literal and maybe old-fashioned sense — means going through your bank statement and checking each transaction against what you’ve recorded in your check register. The idea is to make sure everything is accurate, that your balance is correct, and that your records and the bank’s are in sync.